INVESTORS

Here you will find current information about Greenlight Re, including our earnings and results, SEC filings, stock information, investment returns, as well as our annual reports.

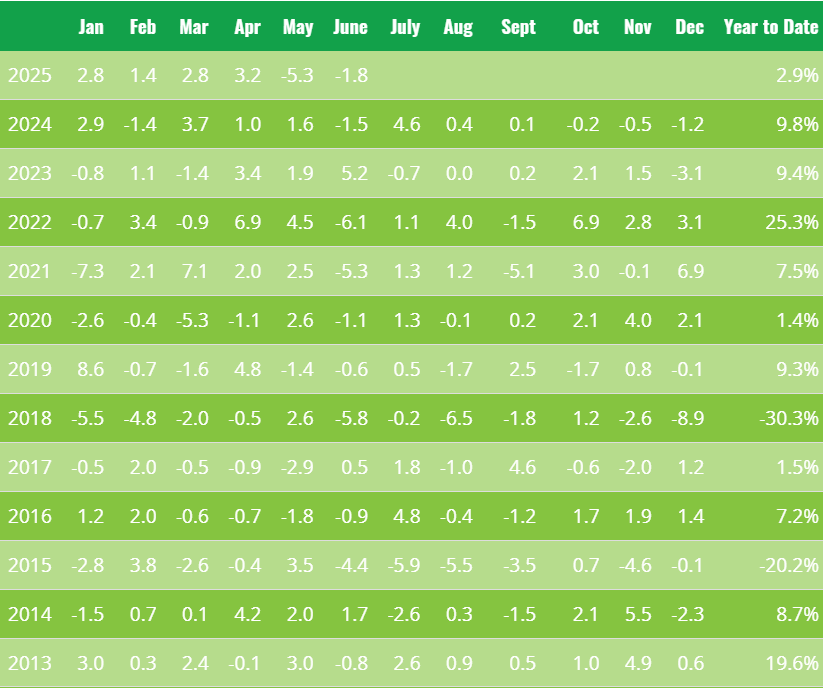

INVESTMENT RETURNS*

ANNUAL FINANCIAL REPORTS

View older reports >Greenlight Reinsurance Ireland, DAC

Greenlight Reinsurance Ireland, DAC, Financial Statements

December 31, 2024

Greenlight Reinsurance Ireland, DAC, SFCR

Greenlight Reinsurance Ireland, DAC, Solvency and Financial Condition Report

December 31, 2024

Greenlight Capital Re, Ltd. Consolidated

Consolidated Financial Statements of GREENLIGHT CAPITAL RE, LTD.

December 31, 2024 and 2023

Greenlight Reinsurance, Ltd.

Financial Statements of GREENLIGHT REINSURANCE, LTD.

December 31, 2024 and 2023

Greenlight Reinsurance Ireland, DAC

Greenlight Reinsurance Ireland, DAC, Financial Statements

December 31, 2023

Greenlight Reinsurance Ireland, DAC, SFCR

Greenlight Reinsurance Ireland, DAC, Solvency and Financial Condition Report

December 31, 2023

Greenlight Capital Re, Ltd. Consolidated

Consolidated Financial Statements of GREENLIGHT CAPITAL RE, LTD.

December 31, 2023 and 2022

Greenlight Reinsurance, Ltd.

Financial Statements of GREENLIGHT REINSURANCE, LTD.

December 31, 2023 and 2022

Greenlight Reinsurance Ireland, DAC

Greenlight Reinsurance Ireland, DAC, Financial Statements

December 31, 2022

Greenlight Reinsurance Ireland, DAC, SFCR

Greenlight Reinsurance Ireland, DAC, Solvency and Financial Condition Report

December 31, 2022

Greenlight Capital Re, Ltd. Consolidated

Consolidated Financial Statements of GREENLIGHT CAPITAL RE, LTD.

December 31, 2022 and 2021

Greenlight Reinsurance, Ltd.

Financial Statements of GREENLIGHT REINSURANCE, LTD.

December 31, 2022 and 2021

Greenlight Reinsurance Ireland, DAC

Greenlight Reinsurance Ireland, DAC, Financial Statements

December 31, 2021 and 2020

Greenlight Reinsurance Ireland, DAC, SFCR

Greenlight Reinsurance Ireland, DAC, Solvency and Financial Condition Report